Adults

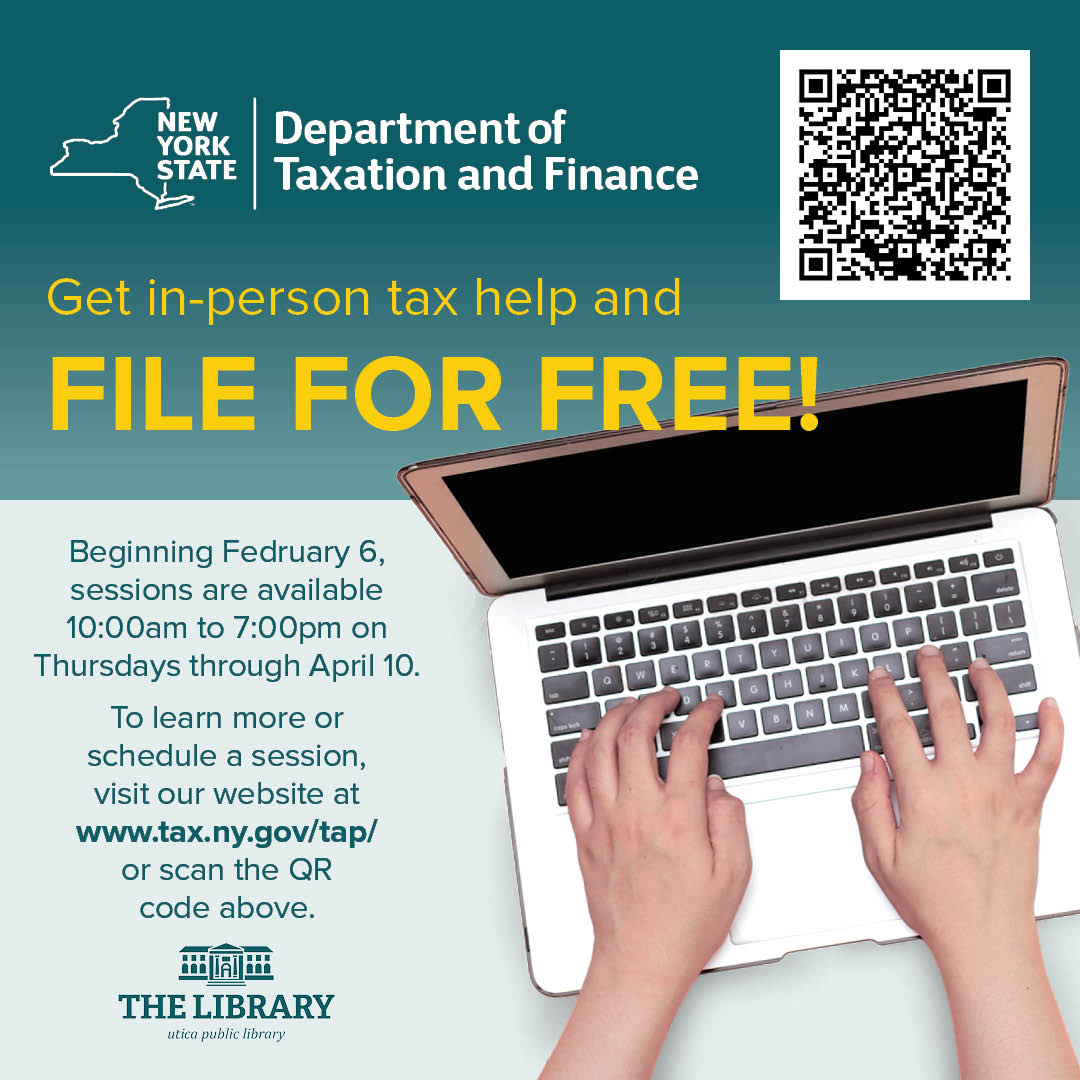

Tax Preparation Assistance Through the New York State Department of Taxation and Finance TAP Program

Thursday, April 10, 2025 / 10:00 AM - 7:00 PM

File your taxes FOR FREE with assistance and software from the New York State Department of Taxation and Finance volunteers through the Taxpayer Assistance Program (TAP). If your 2024 federal adjusted gross income was $84,000 or less and you have investment income of $11,600 or less, you qualify to receive free tax assistance.

What You Need to File Successfully:

- basic computer skills

- an active email account that you can access while filing

- a photo ID (driver license, passport, and so on)

- state issued ID: required to submit New York State return

- all your income documents (W-2s, 1099s, and so on) and other documents available

- a copy of your 2023 tax return (if you filed)

- ability to check the status of your return after it’s submitted to confirm if it was accepted or rejected

Please note: Tax volunteers cannot prepare your tax return for you. They will provide assistance in using the software as you complete your own tax return.

Sign up for a session here or call 315-735-2279 ext 208 for assistance.

- Age(s):

- 18+

- Location:

- Cafe

- Categories:

- Adults